When British data scientist, Clive Humby claimed that “data is the new oil” he set in train thousands of conversations investigating and interrogating the claim. Crucially, he also brought to mainstream attention the power and value of what corporations and governments the world over have known forever – that where there is data, there’s money to be made.

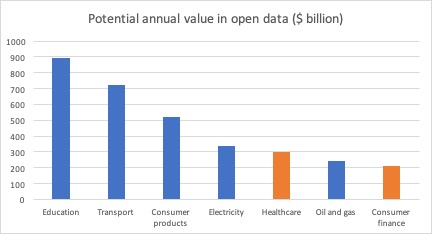

Machine-readable information in its public form – whether generated by governments, individuals or organizations – known as “open data” has been estimated to create $3 trillion in value per year across seven areas of the global economy. Health care and consumer finance are seen as the low hanging fruit of the global data tree, with powerful collection and reporting systems already coupled with international regulatory frameworks. Representing approximately $500 billion in combined value, these two areas provide a fertile and manageable proving ground for data innovation – while providing ready pathways into market categories that are significantly larger – from education and transport to consumer products and electricity to oil and gas.

Source: McKinsey Global Institute analysis

The most promising – and perhaps the most revolutionary aspect of this emerging data market is a simple knowledge that the opportunity is truly global in nature. While the dot-com boom leveled the playing field for enterprises of all sizes and locations, the economic, social and cultural benefits of global digital transformation are still rippling through economies. Despite the uneven distribution of these benefits, there is now a significant digital infrastructure in place not only across developed nations, but throughout many emerging markets. In turn, this infrastructure has yielded massive amounts of structured and unstructured data. Traditionally, emerging markets have experienced a sense of “data poverty” – data that is inaccessible, poorly captured, controlled and distributed – often out of date and difficult to use. This has now been turned on its head, with big data sources now serving as proxies for all kinds of information – from GDP and growth to education, demographics and poverty itself.

Population health, for example, is closely linked to poverty; however, existing measures of poverty are difficult to compare across regions and can be expensive to develop. Researchers have shown that nighttime light measurements captured by weather satellite recordings prove a reliable and locally accurate proxy for assessing economic health.

In their paper, Big Data for Good: Insights from Emerging Markets, Rajesh Chandy, Magda Hassan and Prokriti Mukherji suggest that big data represents a significant opportunity for emerging markets to leapfrog the technical limitations faced by developed economies.

Far from being saddled with the technical debt and legacy systems of 50 years of tech-driven innovation, emerging markets can choose to adopt the latest in cloud-based technologies, low-cost data visualization platforms and a ready pool of data scientists graduating from an ever-more connected global talent pool. The chance to envision a future from the ground up doesn’t only apply to technology, but to wealth creation and data as well.

To understand the wealth creation opportunities that are presented by data, Chandy, Hassan and Mukherji propose a 3Vs framework:

- Validation: there is a need to prove out proxy data in a real world context. For example, mobile phone usage or light intensity is often used as a proxy for poverty/development, proving proxies useful will improve confidence in the use of big data for insight and decision making.

- Visualization: the next generation of researchers will need to upskill in data visualization and data science to better understand and analyse the rich data now available. Visualization tools democratize data.

- Verification: testing the connection between cause and effect in big data sets to ensure that the analysis of the data corresponds to the social impact of innovation.

But while we are envisioning a future for the many, it’s worth going back to the source of the data. At hu-manity.co, we start with the idea that your data is your digital property. That means that you own it and have a fundamental right to share in the value that your data creates. It’s like having a title for the digital footprint of our lives. (Learn more about our software as a service business model here. As well as our work in emerging markets, specifically in the Republic of Liberia here and here.)

With this in mind, we have to add an additional “v” to the research – “veracity”. The great thing about owning your own data is that you can vouch for its truth. Think, for example, where the date of birth on your medical record is incomplete – showing “July 1, 197.” That means you could have been born within a span of 10 years. As complete records are substantially more valuable than incomplete records, we have an incentive to check, amend and vouch for our own data.

What we are imagining and creating at Hu-manity.co is a marketplace where buyers and sellers can come together, creating a traceable link between your data, its commercial use and the buyers and users of that data. This means rethinking a few “little” things – like property, permission and consent, privacy and even “income.”

A small share of the $3 trillion big data market represents a fundamental rebalancing and opportunity for those in emerging markets. When we can validate, visualize, verify and prove the veracity of our data, and where we can claim and enforce our “title” to that data, we’ll be part of a data revolution that not only leapfrogs technological boundaries. We’ll be part of a movement that changes lives – one life at a time.

Gavin Heaton is the President of Asia Pacific Operations for Hu-manity.co.

Photo courtesy of Franki Chamaki.

Source: NextBillion